Eventually, you must take money out of your non-Roth retirement accounts every year—or pay hefty penalties. Learn about RMDs.

If you save and invest wisely, you can leave a substantial amount of money in an individual retirement account (IRA) or 401(k)—but eventually you, or your beneficiaries, will have to start taking money out, which means you'll have to pay taxes on the withdrawals. And you (or your beneficiaries) will be in for financial penalties if you violate the rules for taking the "required minimum distributions" (RMDs).

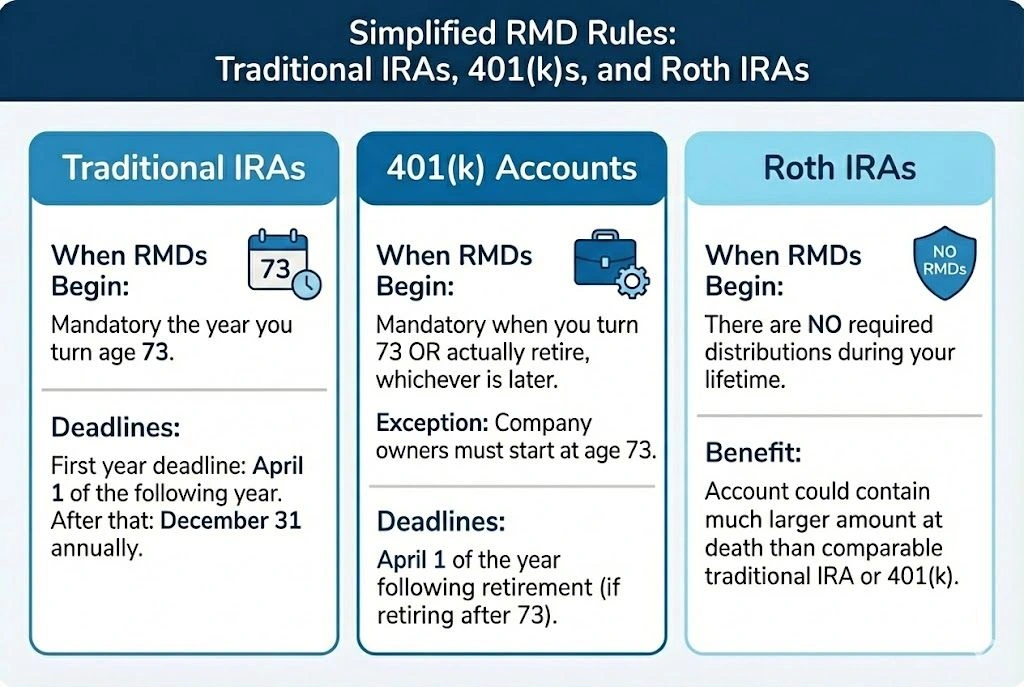

Here's a summary of the complicated rules for taking withdrawals from the various types of retirement accounts.

When Withdrawals Must Begin

The ideal scenario, in the eyes of the IRS, would be to have you exhaust the money in your retirement account at precisely the moment you breathe your last breath. That's why the IRS makes you start withdrawing money in your 70s, and why the amount of these required minimum distributions is tied to your statistical life expectancy. The sooner you withdraw the money, the sooner the IRS gets its tax money.

RMDs for Traditional IRAs

Distributions from IRAs become mandatory the year you turn age 73. (Previously, from 2020-2022, this age was 72, and prior to that, it was 70½. In 2033, the age that mandatory RMDs begin will increase to 75.)

The IRS bases everything on calendar years. You must make one whole year's withdrawal for the calendar year in which you turn 73 (though you don't need to withdraw it all at once). This first year, however, your deadline is slightly extended: You have until April 1 of the following year to make the withdrawal. After that, the deadline is always December 31.

EXAMPLE: Robert turns 73 on November 30, 2024. He must take a full year's required minimum distribution for 2024, but he had until April 1, 2025, to do it. He must take 2025's required minimum distribution by December 31, 2025.

RMDs for Roth IRAs

There are no required distributions from Roth IRAs. As a result, a Roth IRA could contain a much larger amount at your death than a comparable traditional IRA or 401(k).

RMDs for 401(k) Accounts

You don't have to withdraw money from your 401(k) until you turn 73 or you actually retire, whichever is later. If you retire after you're 73, then April 1 of the year following your retirement is the date by which you must make your first required distribution. (But if you're an owner of the company that holds the 401(k), you have to start withdrawing at age 73.)

Calculating the Required Minimum Distribution

The minimum amount you must withdraw each year is based on your life expectancy and that of a theoretical beneficiary. The IRS provides tables on which you can look up your joint life expectancy. You'll use the joint life expectancy table if your spouse is more than 10 years younger than you, but most others will use the uniform lifetime table. After you look up the life expectancy divisor in one of the tables, you simply divide the amount in your account by this number and take out the result as your RMD.

EXAMPLE: Valerie is 75 and she is leaving her account to her husband, who is also 75. The uniform lifetime table gives her a figure of 22.9 years. The balance in her IRA at the end of the previous calendar year was $50,000, so this year she must withdraw $2,183 ($50,000 divided by 22.9).

You don't need to consider your beneficiary's actual age unless the beneficiary is your spouse and is in fact more than ten years younger than you. In that case, you can reduce the amount you must withdraw by using the joint life expectancy table, which factors in your spouse's actual age.

EXAMPLE 1: Jason turns 73 on February 23. That means by April 1 of the next calendar year, he must have made a year's worth of withdrawals from his IRA account. His wife Molly, the beneficiary of the IRA, is four years younger than he is. The minimum amount he must withdraw is determined by the uniform lifetime table.

EXAMPLE 2: Mark names his wife Rita, who is 12 years his junior, as his IRA beneficiary. To calculate his required minimum distribution, he uses the IRS table that calculates his and Rita's joint life expectancy based on their actual ages.

The IRS also publishes a single life expectancy table, but that table is mostly used when there are no beneficiaries or when a beneficiary is calculating RMDs after inheriting a plan.

Why You Don't Want to Miss a Required Distribution

If you don't make the legally required withdrawal, you will forfeit a quarter of the amount you should have withdrawn but did not. That's right: There's a full 25% penalty tax. If you take out the missed amount by the end of the second year after it was due, however, the penalty lowers to 10%. (Prior to the SECURE 2.0 Act, which became effective at the beginning of 2023, the penalty was a truly hefty 50% tax.)

EXAMPLE: When Mae is required to begin taking money from her IRA, she dutifully makes a withdrawal—but mistakenly takes out $1,000 less than she should have. The next year, when she files her income tax return, she must pay a $250 tax (and file an extra form) on the $1,000 she should have withdrawn. But if she takes out that missed $1,000 by the end of that next year (in addition to the RMDs for that year), the tax owed is only $100, or 10%.

Retirement Account Withdrawal Rules: A Summary

Here's a chart that lays out the various rules for withdrawals depending on your age and the type of retirement account.

|

Your Age |

Withdrawal Rules |

|

Younger than 59½ "Premature" withdrawals |

Traditional IRAs: Premature or early withdrawals (taken out before you turn 59½) are subject to a 10% penalty tax, unless you become disabled and cannot work, you die, you use the money to buy your first house, or you set up a plan to make regular, equal withdrawals over your life. You can't borrow from an IRA. (One new exception, introduced by the SECURE Act, is that a new parent can withdraw or borrow $5,000 per child within one year of the child's birth or adoption, without penalty.) Roth IRAs: Withdrawals of contributions are always tax-free. Qualified withdrawals of earnings are penalty- and tax-free if you've had the account for at least five years and you are disabled or are using the money to buy your first house (up to $10,000). 401(k) plans: You can borrow from your 401(k), but can't withdraw money from it except for an IRS-recognized hardship, such as to pay medical bills, prevent eviction or foreclosure, pay college tuition, or make a down payment on your primary residence. And you still must pay the 10% penalty on early withdrawals. There are a few exceptions: If you're 55 or older and actually retired, you can make penalty-free withdrawals. And the new-parent exception introduced by the SECURE Act applies to 401(k)s as well. |

|

59½ to 73 "Ordinary" withdrawals |

Traditional IRAs and 401(k) plans: Withdrawals are optional. The amount withdrawn is included in your gross income for income tax purposes. Roth IRAs: Withdrawals are optional. Withdrawals of contributions and of qualified earnings are not taxed. |

|

73 or older "Required" distributions |

Traditional IRAs and 401(k) plans: Withdrawals are required. The minimum amount is based on your life expectancy and the life expectancy of a theoretical or actual beneficiary, as discussed above. Roth IRAs: Withdrawals are optional. |

Where to Get More Information on RMDs

For the rules straight from the IRS, in all their complexity, see Retirement Topics: Required Minimum Distributions (RMDs).

To read about the rules broken down into plain English, the book IRAs, 401(k)s & Other Retirement Plans, by Twila Slesnick and Tracy Shea (Nolo), offers a thorough discussion of the rules that govern withdrawals from the most common kinds of retirement plans.

You may also want to learn about how your beneficiaries will have to withdraw money from their inherited accounts. To learn about your spouse beneficiary's options upon inheriting your retirement account, see Naming Your Spouse to Inherit Retirement Accounts. To learn about other beneficiaries' options, see Naming a Non-Spouse Beneficiary for Retirement Accounts.